Essential iPad Apps for Organizing your Money

These days a lot of people are turning to their iPad to help them organize their lives. What started out as a device for browsing the internet and watching movies has ended up being a multi-functional device that can help streamline most areas of their lives, from productivity to health and fitness and from cooking through to databases of their record and book collections. One area that the iPad particularly excels is in the number of apps available to help you organize your finances. Whether you’re someone who has always stayed on top of their accounts or whether you are someone who has previously been terrible at keeping their finances organized, there are hundreds of apps out there now that can help you out. All of them allow you to approach your financial record keeping in a new way – rather than having to move papers around constantly from one place to another and then organize then at the end of the year, the iPad encourages you to keep your records up to date day by day and to keep all of your finances instantly organized. The apps that follow are some of the best financial apps for keeping on top of your finances:

Mortgage Calculator: You can tell by the name what this one does, but it does it very well and is incredibly useful if you are in the market for a mortgage or are considering re-mortgaging your house or switching to a different provider. Mortgage Calculator helps you to work through all the different types of mortgage and rates on offer and then calculate what the different rates of interest would cost you per month.

Easy Books: For small business owners and people who need to organize professional business accounts rather than their home family accounts, Easy Book is an excellent app. Easy Books keeps a track of all of your different business accounts and will constantly update all of your balances, assets, depreciations and your sales or purchase invoices. It can be set to update daily, weekly or monthly with various kinds of recurring transactions and to provide alerts for any important financial events. It is free but costs $30 after 120 times of being used.

Xpense Tracker – Another great financial app for small business owners and freelance workers (or anyone who is self-employed and files expenses) , Xpense Tracker is perfect for people who travel (or entertain) a lot on business. It is set up so you can quickly and easily enter the money spent on every meal you eat on business, every plane ticket you buy, every tank of petrol you fill up and every expense you incur. All of these are then totalled up at the end of each week / month for your tax return records. Also included is an app for recording the distance you have travelled in your car and how much fuel you have used. The app costs $15. ![]()

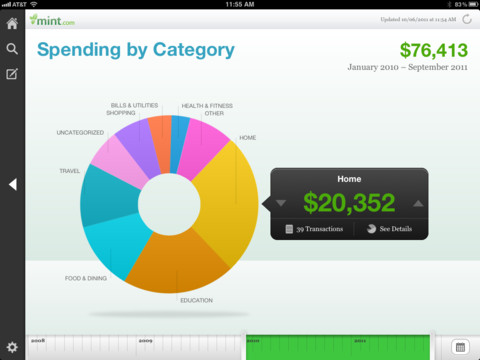

Mint.com – When it comes to financial apps there is one app that is head and shoulders above all the others. The Mint app has been around for years now and is one of the most popular financial apps you can get, having been downloaded by hundreds of thousands of users. That’s because Mint seamlessly links all elements of your finances into one, easy to use place. With Mint you can track all of your personal accounts and organize them into different categories. You can use it to track balances, watch your spending over a given period, analyse what you are spending your money on (in categories such as travel, going out, groceries, gym etc) and then work out where you can make savings. It also monitors how much you have coming in each month and can even alert you when your balance is starting to get a bit low or there are bills that need to be paid. A free app that syncs across all iOS devices, Mint is indispensable.