IDV in Two-Wheeler Insurance Laid Down For Better Comprehension

IDV, short for Insured Declared Value, is the sum of money assured by your insurer in the event of an accident or theft of your two-wheeler. IDV can therefore also be regarded as the current market value of your two-wheeler. In simplified terms, IDV is the compensation that you, as the owner and also policyholder, will receive for a total loss of your two-wheeler from your insurer. You must also be aware that this sum includes only the cost of the two-wheeler. The registration cost for the vehicle is not added in this. It is important to know the details of what IDV entails in terms of its coverages, benefits and so on to make an informed decision.

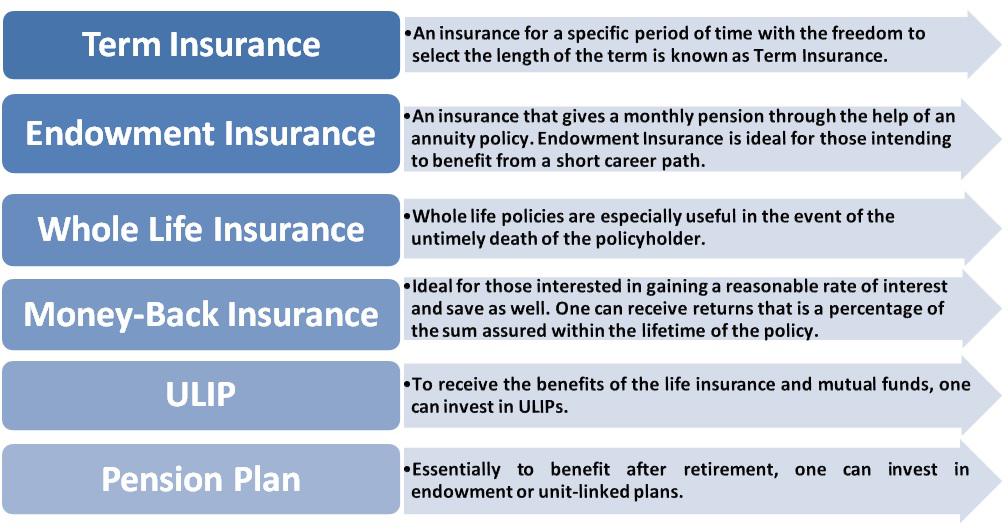

Depreciation Table to fix IDV

| Age of vehicle | Percentage of depreciation to fix IDV of vehicle |

| If vehicle has not exceeded 6 months | 5% |

| If vehicle has exceeded 6 months but is not 1 year old | 15% |

| If vehicle has exceeded 1 year but is not 2 years old | 20% |

| If vehicle has exceeded 2 years but is not 3 years old | 30% |

| If vehicle has exceeded 3 years but is not 4 years old | 40% |

| If vehicle has exceeded 4 years but is not 5 years old | 50% |

In case of two-wheelers that have exceeded five years, the depreciation percentage for fixing of IDV is done by evaluating the condition of its parts. The bike insurance calculator also takes into account the serviceable condition of the vehicle.

Premium of your Bike Insurance

You must be aware that with Bajaj Allianz General Insurance, the most important factor affecting bike insurance premium would be the IDV. If your IDV is low, it would attract a lower two-wheeler insurance premium, which is always favorable. When you are comparing quotes of the various insurance policies that are available, it is crucial that you maintain a constant IDV value. This is the first step towards choosing the most befitting policy for your two-wheeler.

Coverage of two-wheeler insurance

The IDV coverage is subject to alterations from time to time. For a number of different components and different materials, the IDV gets adjusted accordingly. The overall average of these components determines the two-wheeler’s IDV. In case your vehicle is older than five years or has been manufactured by an obsolete manufacturing house, the coverage is determined through an agreement. This is a mutual agreement between the insurer and the insured and it is through this agreement that both stakeholders agree upon a certain IDV. In some cases assistance may also be sought from surveyors to arrive at an IDV. In these situations you will have to bear additional costs for the surveyor consultation.

Benefits of IDV

There are several benefits of having an IDV determined for your two-wheeler insurance because it is precisely that sum which you will be paid in the event of any vehicle related mishap. The right amount of IDV secured is one of the key steps towards filing a successful two wheeler insurance rate. It must also be understood that you can avail high sum of compensation through your IDV when you get it fixed within the first five months of buying the car.