Types of Life Insurance-Understanding the Benefits

Life insurance is a policy that ensures financial security to the beneficiaries benefit after the policy holder dies. It is an important aspect of financial planning. This contract between the policy owner, in this case you,and the life insurance company helps prepare you and your family for life’s uncertainties. A well executed life insurance policy pays out the sum assured following the policy holder’s death. Adequate life coverage indeed makes a difference to your family’s well being.

With the right coverage, life insurance policy covers the risk of dying early, by providing for your family in the event of your death. It also manages the risk of retirement – providing an income for you in non-earning years. Choosing the right policy type with the coverage that is right for you therefore becomes critical.

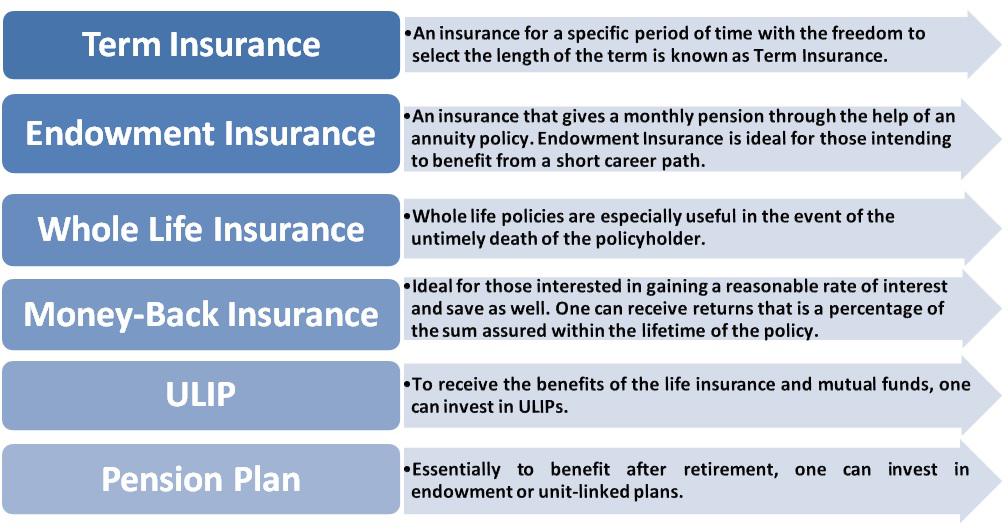

Types of Life Insurance

There are a variety of policies available in the market, ranging from Term Endowment and Whole Life Insurance, to Money Back Policies, ULIPs, and Pension plans. Let’s see what each of these is about, so that you can consider the one that best suits you.

Term life insurance is the most preferred of all the life insurance policies. It has the lowest premium among all insurance plans and exists for a certain period only. Term insurance protects the beneficiaries against financial emergencies following your death. It provides protection for a specific but limited period of time. Typically, the maximum term period for term life insurance policy is 30 years.

Endowment Insurance

Endowment Insurance is great for those with a short career path. It is ideal for those looking to gain maximum benefits from the plan in a life time. Endowment plans are beneficial for policy holders post retirement as it generates a monthly pension through an annuity policy.

Whole Life

Whole life insurance is also known as permanent coverage which offers guaranteed insurance protection for lifetime. Whole Life insurance does carry a growing “cash value” component that assures a guaranteed amount by virtue of a contract (at low interest rate) until surrendered. Since the death benefit is guaranteed, it is most useful in the event of untimely death.

Money-Back Plan

In a Money-Back plan, you keep receiving a share of the sum assured throughout the existence of your policy. These plans are perfect for those looking for something that offers both – coverage as well as savings. It has long-term savings prospects, and promises a reasonable return too, especially since the payout is exempted from tax deduction,with the exception of under individual situations.

ULIP

Unit-linked Insurance Plans (ULIPs) are immensely popular due to their combined benefits of life insurance policies with investments. Here, a certain part of your premium is invested in different types of funds like equities where your wealth can grow gradually;while the rest is used to supply for life insurance and fund management expenses. It gives you the flexibility to invest as per your risk profile. You have the freedom to change your fund plan a number of times during the term, and also alter your investment strategies. Besides, it also gets you death benefits as offered by typical Term Insurance Plans.

Pension Plan

Pension plans, also known as retirement plans, help individuals plan effectively for the future. Basically, they help you build a retirement corpus. For, it provides you with a regular income stream post retirement, better known as annuity.